8 Easy Facts About Lamina Loans Described

Table of ContentsThe Only Guide to Lamina LoansLamina Loans Fundamentals ExplainedEverything about Lamina LoansThe Best Guide To Lamina LoansExcitement About Lamina Loans

If you're looking for a lasting funding (like over the training course of the next years), a variable rate of interest loan may not be best. When you request a funding, you typically require a good credit history as well as income to verify you're a reliable candidate for a funding. If you don't have a strong credit report history, you could need to discover somebody else that does.A cosigner's credit history score can protect you a car loan when you wouldn't otherwise qualify. While paying your financing on time can boost your credit report (as well as theirs), not paying it back on time can trigger your credit score as well as theirs to drop.

Compare prices from multiple lending institutions in 2 mins Regarding the writer Dori Zinn Dori Zinn is a pupil funding authority as well as a factor to Legitimate. Her work has shown up in Huffington Message, Bankate, Inc, Quartz, as well as more.

A (Lock A secured padlock) or implies you have actually safely connected to the. gov website. Share sensitive information just on authorities, secure websites.

6 Simple Techniques For Lamina Loans

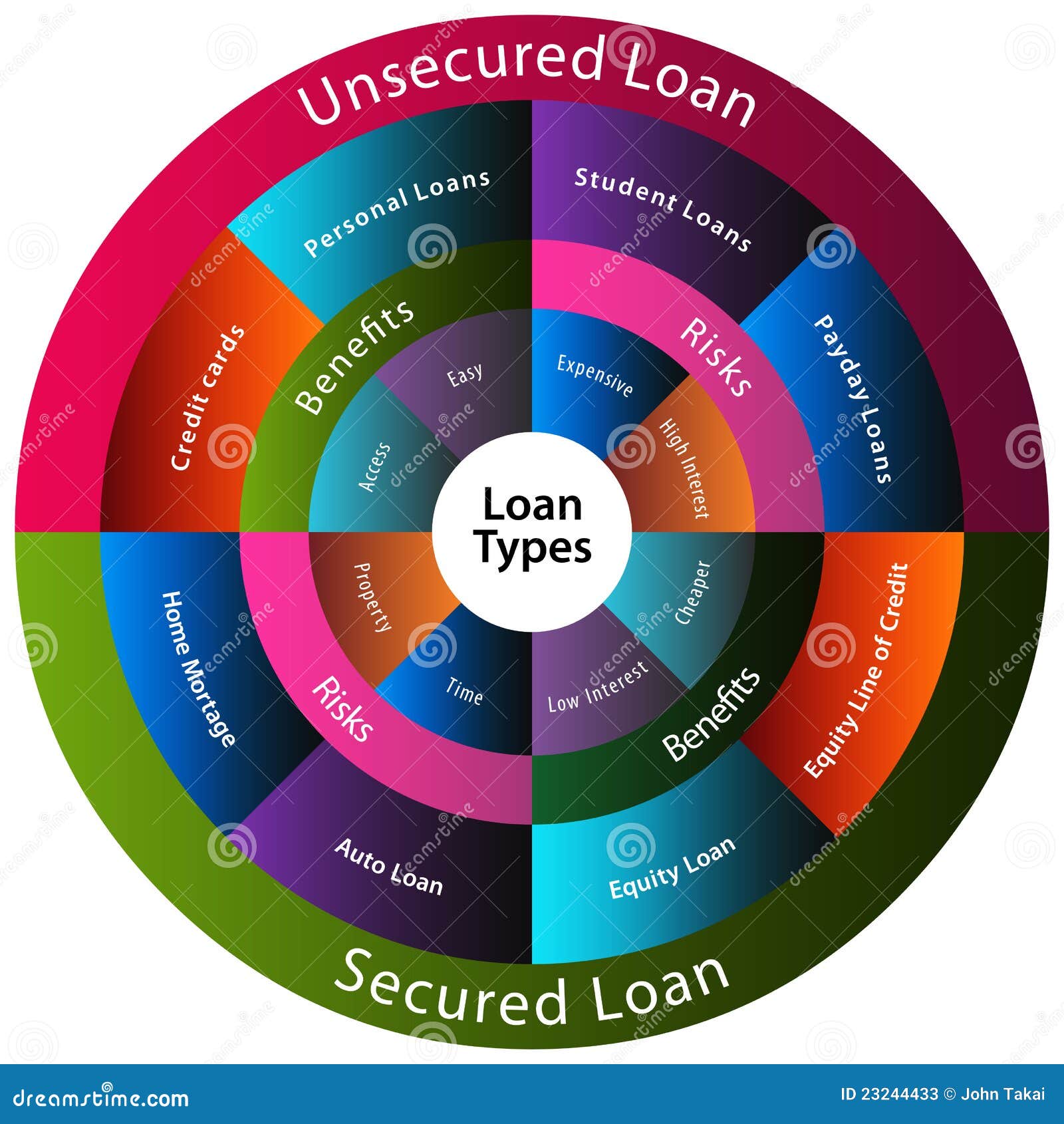

A financing is when a sum of money is provided to another event or individual, usually consisting of passion and various other fees, for the future repayment of the financing. When the debtor tackles the lending, they accept a set of terms that could consist of rate of interest, finance charges, as well as repayment days.

Fundings are a type of financial obligation, and loan providers will review your creditworthiness, generally consisting of factors such as your debt scores and also reports, before using you a financing with its involved loan terms, including rates of interest. The better your credit rating, the most likely you'll be used a lending with far better terms.

Initial info regarding the various kinds of plastic cards readily available, covering bank card, shop cards as well as fee cards, and also early repayment cards. Lamina Loans. Details about exactly how hire purchase and also conditional sale agreements work, the right to end a hire purchase arrangement as well as what occurs if the buyer is unable to pay. Points you can do to aid take care of or settle your overdraft.

Covers credit brokers and the charges made for their solutions. Information concerning buying things from a brochure as well as being a representative for a catalogue business. Info regarding what a pawnbroker is and also what takes place if you are incapable to settle your lending, lose your ticket or do not accumulate the items.

Fascination About Lamina Loans

ARM fundings are normally called by the size of time the rates of interest remains set and exactly how usually the rate of interest undergoes change afterwards. In a 5y/6m ARM, the 5y stands for a first 5-year period during which the interest price stays taken care of while the 6m reveals that the passion rate is subject to change when every 6 months thereafter.

These finances tend to enable a lower deposit and credit rating when contrasted to conventional loans.FHA loans are government-insured fundings that can be an excellent suitable for buyers with restricted revenue as well as funds for a deposit. Financial Institution of America (an FHA-approved lending institution) provides these lendings, which are guaranteed by the FHA.

The smart Trick of Lamina Loans That Nobody is Discussing

Peer-to-peer (P2P) loaning functions by matching consumers with discover here lenders through P2P financing platforms. These platforms function like industries bringing with each other people or services that wish to provide money, with those that want a car loan. Relying on the system, you might not have the exact same defense as when you obtain in other ways.

A term financing is merely a car loan offered for organization purposes that requires to be paid back within a defined period. It normally carries a fixed rate of interest, month-to-month or quarterly settlement routine - as well as includes an established maturity date. Term finances can be both secure (i. e. some security is offered) and unprotected.

An overdraft account center is taken into consideration as a resource of brief term financing as it can be covered with the next down payment. Lamina Loans. A letter of credit score is a file provided by a banks assuring settlement to a vendor offered specific papers have actually been provided to the bank. This makes certain the payment will certainly be made as long as the solutions are performed (typically the dispatch of items).

Our Lamina Loans Diaries

At the conclusion of the leasing period, the owner would have recuperated a large part (or all) of the first price of the recognized property, in addition to passion gained from the rentals or installments paid by the lessee. The lessee additionally has the find out this here alternative to acquire possession of the recognized property by, for instance, paying the final service or installation, or by negotiating a last purchase cost with the owner.

The lessee has control over the possession, as well as makes usage of it as called for. This is typically a business financing used to SMEs as well as are collateral-free or without 3rd party warranty. Here the consumer is not required to provide security to make use the funding. It is offered to SMEs in both the startup as well as existing phases to serve working capital needs, acquisition of devices, sustain development plans.

This car loan center is provided to firms with more than 2 years of service experience, existing proprietors of a minimum of 2 business automobiles, restricted consumers and also carriers (Lamina Loans). It is essential to note that these are only basic summaries. Lenders have their particular car loan analysis as well as documentation requirements before a lending decision is taken.